“Do you think IPwe will facilitate the use of intellectual properties as collateral for financial institutions?” I was recently asked this question. In fact, the Japanese government has been promoting IP-based lending for several years. The government bears the cost of IP evaluation for financial institutions. However, at prsent, financial institutions don’t seem to regard […]

It was reported that the Japanese government has begun to consider a system that would allow companies to pledge intangible assets such as technologies and customer base as collateral in one fell swoop. Nikkei: 中小の無形資産を一括で担保に 金融庁、融資改革で支援 In Japan, it has been pointed out that bank loans, especially to small and medium-sized enterprises (SMEs), focus on real estate […]

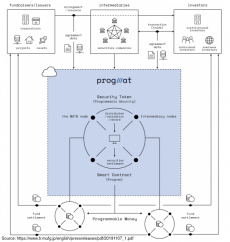

Japan’s blockchain enabled next-generation financial transactions are planned to start in 2020. On November 7 2019, Mitsubishi UFJ Trust and Banking Corporation (MUTB), the second largest in trust business in Japan, announced the establishment of the Security Token Research Consortium consisting of 21 companies, and the development of next-generation financial transaction services using blockchain technology. […]

Recently, alternative lending has been attracting attention in Japan. Alternative lending is a business loan option that falls outside of a traditional bank loan. For example, a Japanese electronic commerce and Internet company Rakuten gives a loan to its online shopping site owners using daily accounting data, and an accounting software company Yayoi also provides […]