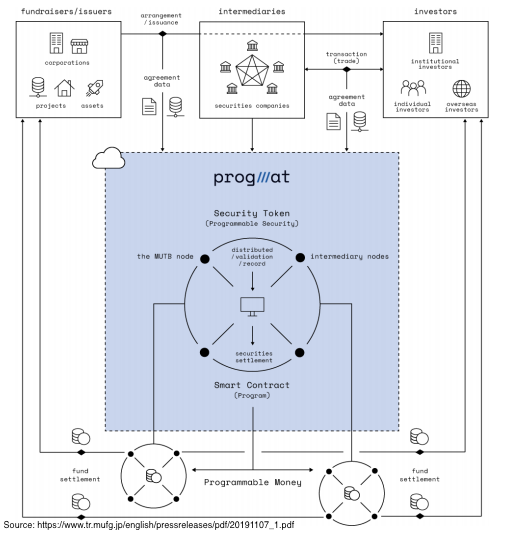

Japan’s blockchain enabled next-generation financial transactions are planned to start in 2020. On November 7 2019, Mitsubishi UFJ Trust and Banking Corporation (MUTB), the second largest in trust business in Japan, announced the establishment of the Security Token Research Consortium consisting of 21 companies, and the development of next-generation financial transaction services using blockchain technology.

They state that, “By combining security token and smart contract technology, as well as collaborating with external programmable money, which is expected to be adopted in the future, the Service will enable efficient financial transactions on our program base with the aim of making it possible to do fundraising and management on one platform, managing a “variety of financial products” (bonds, securitized products, etc.) “anytime” (24 hours a day, 365 days a year), “anywhere” (accessible without an exclusive terminal), and with “anyone” (including individual retail investors and overseas investors).”

As previously reported, MUTB has also developed personal data brokerage business. So, it looks like the most innovative company in the Japanese financial industry.

Japanese trust bank to launch personal data brokerage business

It is reported that MUTB is aiming to start this new service during fiscal 2020. It also reports that the securitized products in this service will include intellectual properties, and companies will be able to collect funds based on such intellectual properties.

In Japan, the government has been promoting the IP financing by preparing the “IP Business Evaluation Report”. However, as reported before, the financial institutions do not necessarily rely on such report to make a decision as to whether they can lend money, at the current moment.

Japanese local banks to increase chances to give a loan using IP information

As you know, intellectual properties such as patents may sometimes be invalidated and deemed to have never existed. Also, the value of patented technologies vary depending on technological trends. So, estimating the value of patents is not easy. In order to realize the credibility and safety of IP transactions, it is desirable to establish a valuation method for indicating the amount that can be actually cashed in the market.

Thank you for reading. If you enjoyed this post, I’d appreciate it if you’d help it spread by emailing it to a friend, or sharing it on social media. Thanks!